Export-Import Insurance Company Uzbekinvest operates in the field of “General Insurance” and provides services in all 17 insurance classes according to insurance business classification.

Date of Establishment:

Uzbekinvest Insurance Company was established according to the Decree of the President of the Republic of Uzbekistan N UP 745 dated by 21st January 1994 in April, 1994 and Resolution of the Cabinet of Ministers of the Republic of Uzbekistan N 206 dated by 13th April 1994.

Reorganized into Uzbekinvest National Export-Import Insurance Company with status of the official state agent in export credit and investments insurance according to Decree of the President of the Republic of Uzbekistan N UP 1710 dated by 18th February 1997 and Resolution of the Cabinet of Ministers of the Republic of Uzbekistan N 113 dated by 28th February 1997.

On July 1, 2020 according to the Decree of the President of the Republic of Uzbekistan "On measures to expand the mechanisms of financing and insurance protection of export activities" and in accordance with the Decree of the Cabinet of Ministers of the Republic of Uzbekistan "On measures to further improve the activities of Uzbekinvest, the company was transformed into a joint stock company.

Share Capital: 296,3 billion soums.

Shareholders of the Company:

Ministry of Investment, Industry and Trade of the Republic of Uzbekistan (79.37%);

JSC National Bank for Foreign Economic Affairs of the Republic of Uzbekistan (15.87%);

Other legal entities and individuals (4.76%).

Mission of the Company: to contribute to development of insurance sector of Uzbekistan by providing high quality insurance services at reasonable prices.

Company’s Objectives:

- providing comprehensive insurance protection for economic interests of the national exporters abroad against political, commercial and entrepreneurial risks preventing foreign partners from fulfilling obligations taken;

- providing insurance guarantees to commercial banks – residents of Republic of Uzbekistan - providing credits for financing export of technologies, goods and services in accordance with international principles of export credit insurance;

- providing comprehensive insurance protection for property and individual interests of foreign investors investing into economy of the Republic of Uzbekistan;

- developing direct cooperation with the international, foreign, and national state and private insurance companies and carrying out mutual insurance activity and reinsurance operations.

Working Order:

Monday-Friday, 9:00 to 18:00

Saturday-Sunday – rest days

Company’s Infrastructure:

Head office;

14 territorial branches in Tashkent city, in all regions of the republic and in the Republic of Karakalpakstan;

200 district divisions by the Republic, including 26 city divisions;

More than 800 insurance agents.

Specialized subsidiaries:

- Uzbekinvest International Insurance Company

The company for insurance foreign investments into Republic of Uzbekistan against political risks

- Uzbekinvest Assistance Ltd

Medical and legal assistance service

- Uzbekinvest Sarmoyalari Investment Company

Investment activities

- Uzbekinvest Hayot Insurance Company Ltd.

Life insurance Company

Advantages and development perspectives:

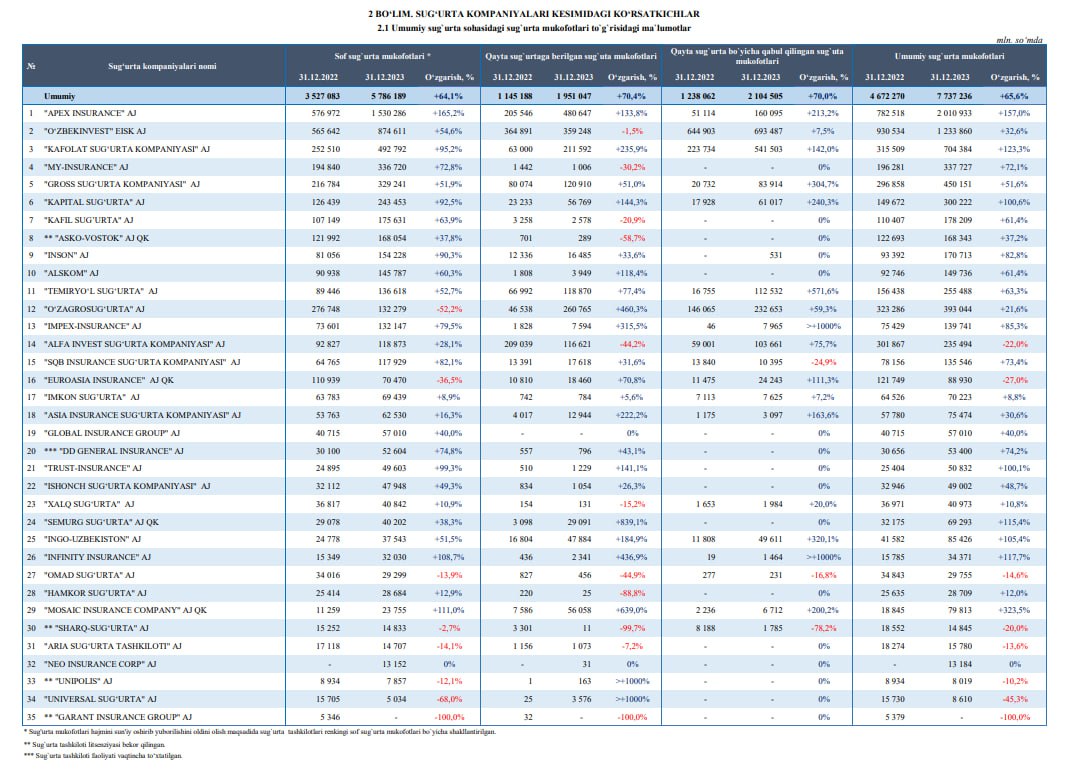

Uzbekinvest is the leading insurance company in the market taking over last years insurers’ rating headlines by insurance premium gathered.

In 2016 Uzbekinvest was the first company in Uzbekistan, which has passed re-certification and received certificate of its quality management system’s conformity with the new ISO 9001:2015 standards issued by the SGS international certification body (Switzerland).

On December 5, 2019, the international rating agency Moody's Investors Service (USA) officially announced an increase in the financial stability rating of Uzbekinvest insurance company from B1 to Ba3 with a Stable forecast. The Uzbekinvest insurance company became the first company in the banking and financial sector of Uzbekistan, which was assigned the International rating of financial stability "Ba3" by the International rating agency "Moody's".

By the results of 2020, the rating agency Ahbor-Reyting assigned the Company a solvency rating on the national scale at “uzA ++” with a “Stable” forecast.

For the first time in the insurance market of Uzbekistan, the International rating agency "A.M. Best" has assigned a rating to Uzbekinvest Export-Import Insurance Company JSC at B and an issuer rating at bb with a Stable forecast

There is well-organized team of experts in Uzbekinvest who guarantee their clients:

- Optimal combination of price and quality of insurance protection;

- Strict observance of liabilities and efficiency of actions;

- Individual approach to requests and needs of each client;

- Modern insurance technologies and various insurance programs;

- Service by international quality standards and flexible insurance rates.

The further growth strategy of the Company is aimed at strengthening market positions in the corporate and retail sectors, introducing new modern insurance products and programs, developing information technologies in insurance activities, as well as continuously improving the sales process and post-sales services in accordance with the needs of customers.