In the first half of 2023, the insurance company Uzbekinvest more than doubled key business indicators

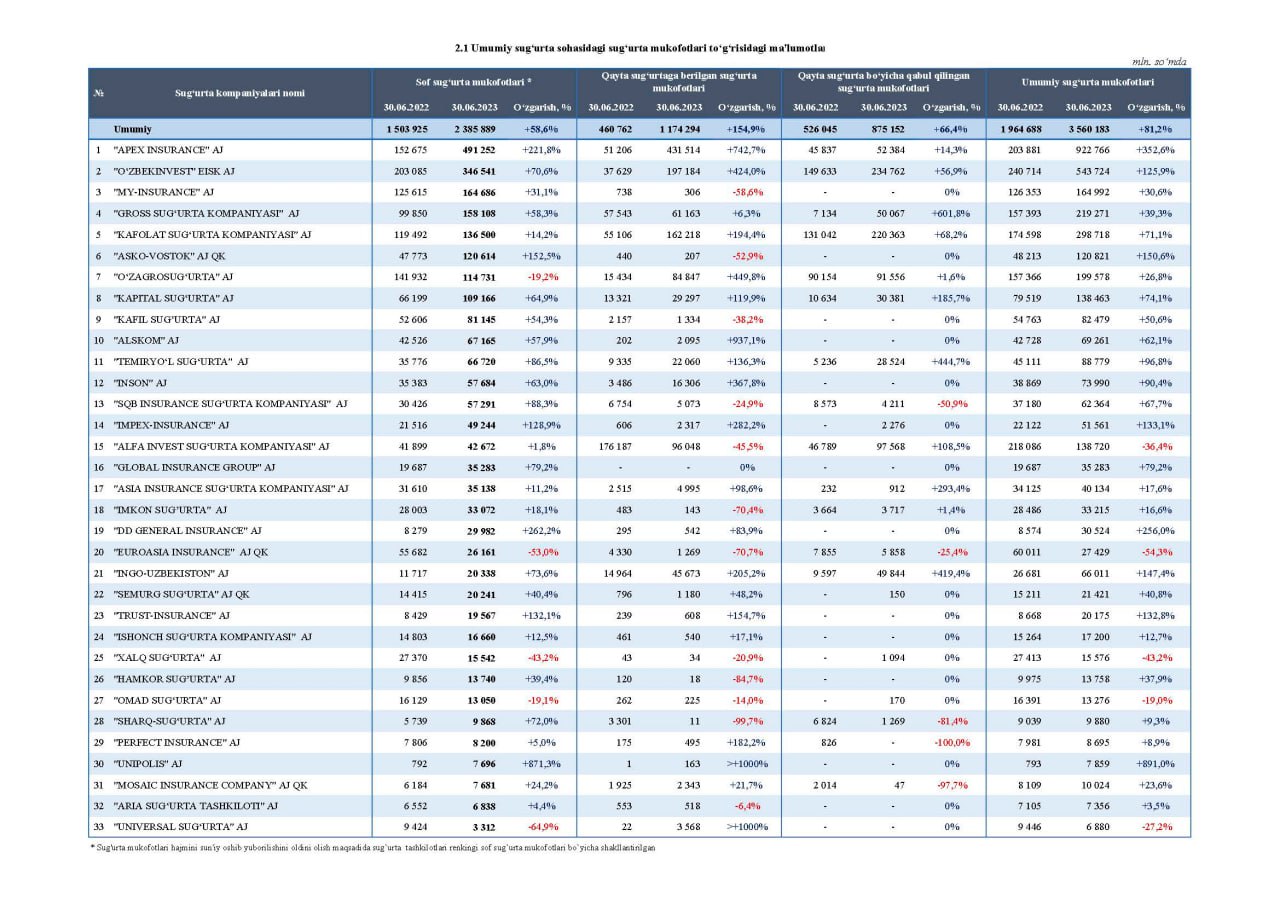

At the end of the first half of the year, Uzbekinvest strengthened its leading position in the domestic insurance market, demonstrating sustainable development dynamics and stable growth in key business indicators. In the first 6 months of 2023, the volume of premiums collected by the company amounted to 543.7 billion soums, which is 2.3 times more compared to the same period in 2022.

In the first half of 2023, the Uzbekinvest insurance company, continuing to implement the state policy to develop the export potential of the republic and comprehensive support for national exporters of goods, works and services, provided insurance protection to exporters in the amount of $1.2 billion.

In May 2023, the international rating agency Moody’s Investors Service (USA) officially announced an increase in the outlook for the Uzbekinvest insurance company from “Ba3” with a “Stable” outlook to “Ba3” with a “Positive” outlook. “Uzbekinvest” is the first company in the banking and financial sector of Uzbekistan, which was assigned the International Financial Strength Rating “Ba3” by the International Rating Agency “Moody’s”.

During the first half of 2023, the dynamic and sustainable development of insurance operations in the international insurance and reinsurance markets continued. The gross collection of reinsurance premiums was ensured in the amount of $20.2 million. At the same time, the share of exports of insurance services in the company's insurance portfolio amounted to 42.7%.

Following the tasks set by the President of Uzbekistan

To radically expand the range of services provided to the urban and rural population of the country, the Uzbekinvest company has identified one of the priority areas of its activities as providing insurance protection to the rural and urban population by conducting active outreach work locally using the mahallabay system. New insurance agents from among young people and university students are involved in the development of sales of insurance products. During 6 months of 2023, insurance agents sold policies worth 16.7 billion soums, which is 6 times more compared to the same period in 2022.

Well-established systematic cooperation with leading international insurance and reinsurance companies, such as: Allianz SE (Germany), Zurich Insurance Group (Switzerland), Tokio Marine & Nichido Fire Insurance Co (Japan), AXA (France), People Insurance Company of China (China) ), Korean Reinsurance Company (South Korea), Marsh (USA), AON and UIB (UK) contributed to the establishment of Uzbekinvest as a recognized participant in the international insurance market.

The company ensured the collection of insurance premiums in the corporate segment in the amount of 265.4 billion soums, with an increase of 4 times compared to the results of the first half of 2022, and concluded more than 51 thousand contracts with legal entities.

In the insurance segment of individuals, the collection of insurance premiums in the amount of 41 billion soums was ensured, with an increase of 1.7 times compared to the same period last year, more than 467 thousand contracts were concluded.

Thanks to systematic work on the quality of services provided, during 6 months of 2023, the digital platforms of the Uzbekinvest company made it possible to sell more than 401 thousand online policies, which amounted to 77.2% of the total share of policies sold.

During the first half of 2023, the payment of insurance compensation in the amount of 45.5 billion soums was ensured, while insurance compensation to national exporters amounted to 3.6 billion soums.

Systematic continuous training of company employees plays a key role in ensuring high rates of business growth. As part of the ongoing “Insurance School” for ordinary employees and the “Insurance Academy” for executive employees, in April 2023, 11 managers of regional branches of the Uzbekinvest insurance company underwent advanced training in the city of Seattle under a program developed by specialists from the University of Washington. According to the training program, representatives of the Uzbekinvest company completed an internship at one of the largest insurance companies in the USA - PEMCO Insurance Company, founded in 1949.

Also in June 2023, 15 managers of the company’s district branches completed advanced training courses in the Insurance course at the University of West Bohemia in Prague (Czech Republic).

The Uzbekinvest Company once again confirmed the high level of reliability and compliance of its products with international standards, having successfully held a test in May of this year. audit for compliance with the requirements of the international standard “ISO 9001:2015”. The international certification body CERT International (Slovakia) certified the company.

Today, digital technologies, such as data fusion systems and artificial intelligence, are used in all areas of the economy, allowing to significantly reducing the time and resource costs of business. The Uzbekinvest company, guided by the principle of optimizing the processes of analysis, risk assessment, decision-making and document preparation, has implemented a program for analytical segmentation when issuing OSGOVTS and CASCO policies. This program allows, based on artificial intelligence, to identify transport risks of clients in which an insured event is most likely to occur. The introduction of this technology makes it possible to improve the quality of decisions made and the profitability of OSGOVTS and CASCO products.The company also introduced the “Decision Making System” program, which is a universal scoring system that allows you to connect an unlimited number of external sources of information on fines, loans and other types of data for programming risk assessments in various areas. This system is aimed at introducing automatic underwriting based on machine learning in various insurance segments.

In the second half of 2023, the company intends to complete systematic work on the transfer of all main business processes into digital format based on artificial intelligence technology.